Are you looking for an easy way to earn passive income from cryptocurrency? In this post, we'll break down the best methods for investors like you, ranging from easy to hard!

Best Crypto Staking Platforms

| Platform | Highest Interest Rate | Supported Cryptocurrencies |

| ByBit | Up to 559.62% | 50+ cryptocurrencies, including Bitcoin, Ethereum, Dogecoin and more |

| Binance | Up to 141.54% | 340+ cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Dogecoin, stablecoins and more |

| OKX | Up to 49.87% | 100+ cryptocurrencies, including Apecoin, Ethereum, LookRare, Sushibar, Compound, USDT, USDC and more |

| Nexo | Up to 35% | 35 cryptocurrencies, including Bitcoin, BNB, Chainlink, Ethereum and more |

| YouHodler | Up to 13% | 30 cryptocurrencies, including Litecoin, Ethereum, Bitcoin and more |

| Crypto.com | Up to 12.5% | 21+ cryptocurrencies, including Bitcoin, Ethereum, Algorand, Cardano, Dai, stablecoins and more |

| AQRU | Up to 10% | USDC, Bitcoin, Ethereum |

| Ledn | Up to 9.5% | Bitcoin and USDC |

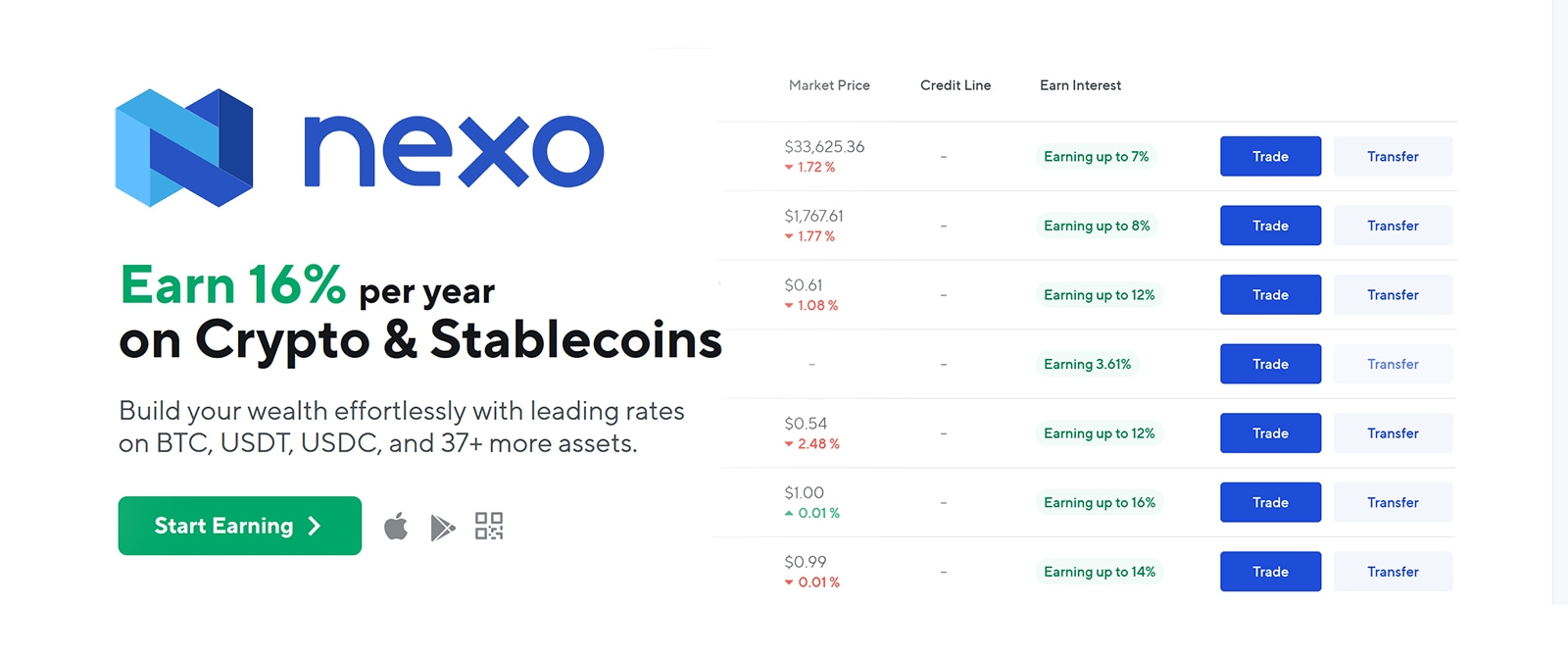

Nexo is an all-in-one crypto platform offering services such as buying, exchanging, and storing Bitcoin and various cryptocurrencies. Key features include a single wallet for borrowing, earning interest, and exchanging over 500 pairs of cryptocurrencies. Register and deposit a minimum of $500 on the platform, and you will receive up to $35 BTC bonus.

HODL your crypto and earn

The most popular methods for passive income are earning interest, staking and lending. So this involves holding cryptocurrencies to earn, the difference lies in where and how this holding is done.

Earning interest

Many cryptocurrency exchanges offer interest rewards on cryptocurrencies. For instance, ByBit offers rewards of over 30% to users holding USDC.

Staking

Holding cryptocurrencies on a specific blockchain network to support that network and receive rewards in the same cryptocurrency. The amount you stake can be locked for a specific period or unlocked.

Lending

By lending crypto to borrowers such as traders and businesses, you can earn interest! Lending platforms and DeFi protocols facilitate the process, making it easy for you to earn rewards!

Besides classical staking, we have more advanced staking methods and riskier options like:

Liquidity Providing

LP involves adding cryptocurrencies to liquidity on decentralized exchanges (DeFi). This is often rewarded with fees and tokens for the protocol where you provided liquidity.

Yield Farming

This strategy involves swapping cryptocurrencies among various DeFi protocols to maximize returns and earn rewards.

DAO rewards

In the DeFi ecosystem, you can buy DAO (Decentralized Autonomous Organization) tokens and receive dividends or vote on decisions within the DAO.

How to get free bitcoin

and another cryptocurrencies

Earn crypto with trading

Make money by sharing internet

Earn by playing a game

Testing Services and Apps

Get paid for searching the web